Amidst the COVID-19 pandemic, the two-vessel portfolio of Crystal Cruises filed for bankruptcy. During the worldwide pandemic, Genting Hong Kong, a division of Genting Group, which operates integrated resort casinos in Malaysia, Singapore, the United Kingdom, the Philippines, and the United States, neglected to pay Crystal Cruises' invoices and docking fees. As a result, in February 2022, authorities in Freeport, Bahamas, confiscated Crystal Symphony and Crystal Serenity, which were subsequently put up for auction in June of the same year.

A&K Travel Group, a division of Heritage Group, a private equity firm, placed the highest bid. Italian billionaire Manfredi Lefebvre d'Ovidio, who founded Silversea Cruises and sold a majority stake to Royal Caribbean in 2018 for $1 billion, is in charge of Heritage. Antonio is the father of the company.

For an undisclosed sum, A&K Travel purchased the two cruise ships that make up the Crystal Cruise brand. However, according to trade publication Travel Weekly, the 1995-built Symphony and the 2003-built Serenity were sold for $25 million and $103 million, respectively.

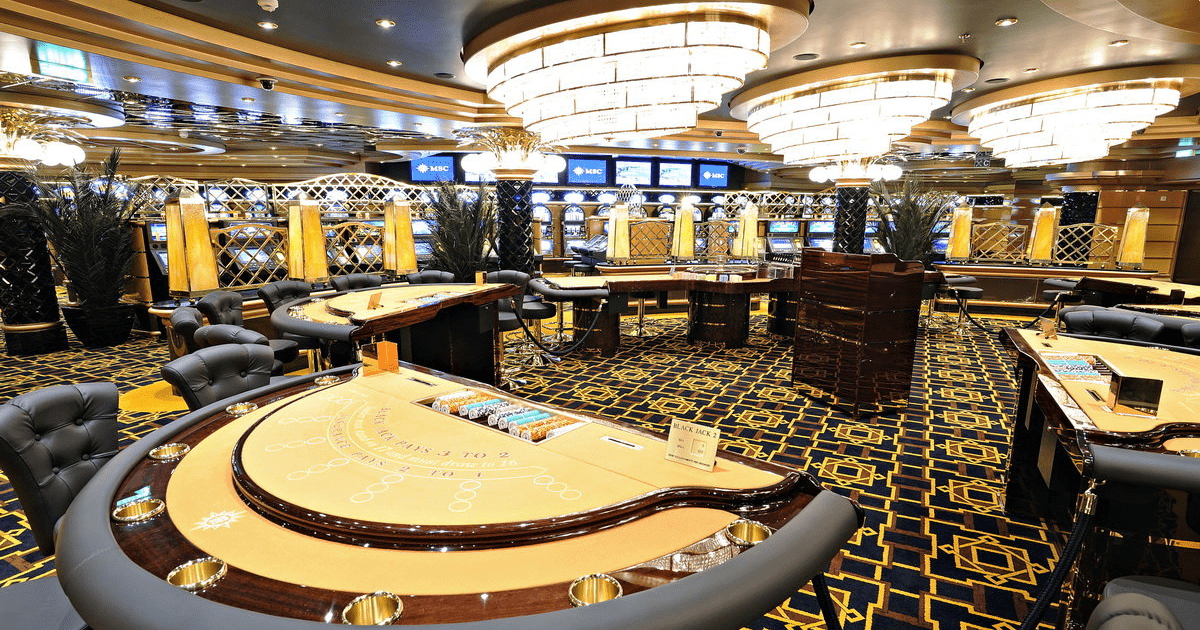

After acquiring Crystal Cruises, A&K Travel believed the Genting floorplan undervalued the sailor experience. The corporation also thought that the casino areas on the ships were far too big. Next month, guests traveling on Crystal Serenity and Symphony won't be able to partake in gambling. According to A&K, a post-acquisition customer survey revealed that merely 5% of Crystal Cruise's prior patrons expressed that they would not embark on a voyage without a casino.

The survey did find, however, that if a casino were open, enough people would use it. A&K will now have to start over from scratch. Sometime in 2024, the company intends to integrate casinos, albeit with much smaller gaming areas than the ships that once held them.

During the Serenity shakedown, A&k listened to the feedback from travel partners, and already making plans to address the issue of neither ship having a casino.